Profit Calculator Calendar Spread

A Calendar Spread strategy profits from the time decay andor increase in the implied volatility of the options. A diagonal call spread is similar to a calendar call spread in that it consists of two calls with different expirations.

Forex Forex Trading Forex Factory Forex Signals Forexlive Forex Trading App Forex Rates Forex Calendar Forex Trad Forex Trading Forex Forex Trading Strategies

Neutral Limited Profit Limited Loss A neutral to mildly bearishbullish strategy using two calls of the same strike but different expiration dates.

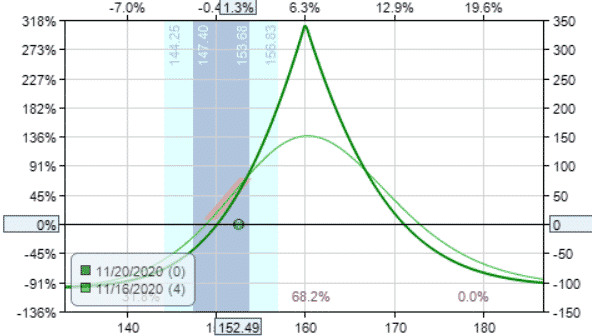

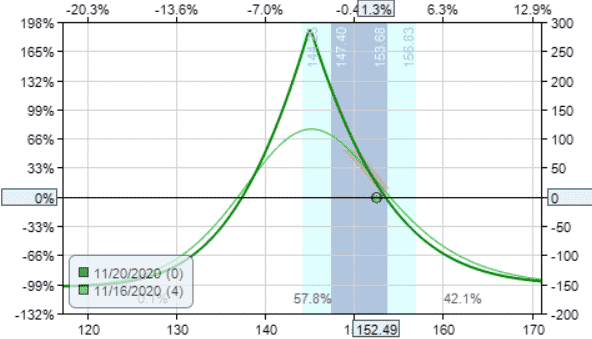

Profit calculator calendar spread. A bullish vertical spread strategy which has limited risk and reward. Clicking on the chart icon on the Calendar Call Spread screener loads the strategy calculator with the selected calendar call. Profit increases with time as well as from an increase in vega.

Call Spread Calculator shows projected profit and loss over time. Use the Ally Invests Profit Loss Calculator to estimate whether this seems possible. A calendar call spread consists of two calls with the same strike price but different expirations.

For example lets say IBM is 200 on 1 February. A guideline we use is within 1 strike of the calendar spread s strike price. A Calendar Spread is a low-risk directionally neutral strategy that profits from the passage of time andor an increase in implied volatility.

To calculate the profit on the above Bull Call Spread order. Clicking on the chart icon on the calendar call spread screener loads the strategy calculator with the selected calendar call. This strategy is almost neutral to changes in volatility.

Wait until you receive your monthly statement ___C. A long Calendar Spread which is also referred to as Time Spread is a trading strategy for derivatives is a direction neutral and low-risk strategy that profits from theta ie. At the time of the near-term call expiration date the price of the short call was 150 which is 300 less than we sold it for.

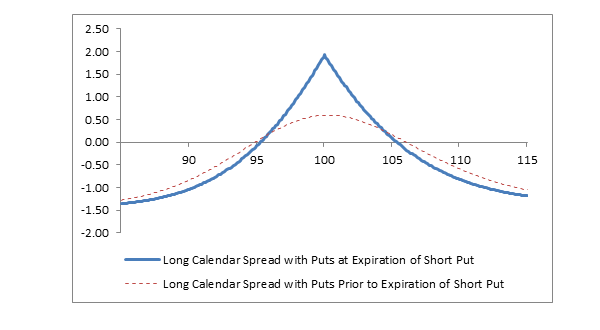

A calendar spread involves the purchase of an option in one month and the simultaneous sale of an option at the same strike price in an earlier month for a debit. What is a calendar call spread. A calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates.

Subtract the open premium from the close premium X 100. As a reminder the price of a long call calendar spread is calculated by subtracting the price of the short option from the long option. We could purchase the April 200 call for 400 and sell the March 200 call for 300.

A call spread or vertical spread is generally used is a moderately volatile market and can be configured to be either bullish or bearish depending on the strike prices chosen. With calendar spreads you can set a stop loss based on percentage of the capital at risk. Step 1 - Importing the Libraries.

Watch the video below to learn more NavigationTrading 2021-05-24T1608290000. If your profit target is 50 and your stop loss is 50 then any success rate greater than 50 will see you come out ahead. When establishing one-month calendar spreads you may wish to consider a risk one to make two philosophy.

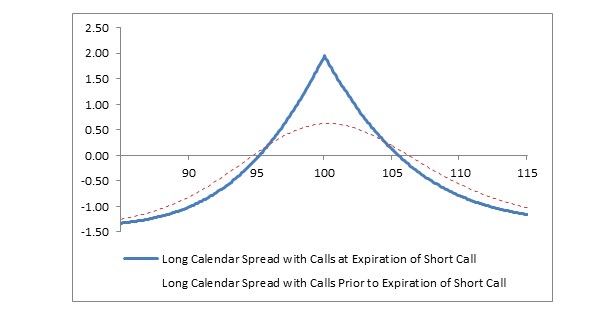

Calendar spread profit calculator. The forecast therefore can either be neutral modestly bullish or modestly bearish depending on the relationship of the stock price to the strike price when the position is established. A long calendar spread with calls realizes its maximum profit if the stock price equals the strike price on the expiration date of the short call.

Subtract 5815 from 6350 ___B. The goal is for the stock to be above strike B at expiration. Others might set it as 50.

Purchasing a call with a lower strike price than the written call provides a bullish strategy Purchasing a call with a higher strike price than the written call provides a. This video provides step by step detail on how to calculate your profit or loss on a Calendar Spreadeven after several adjustments. The Diagonal Call Spread Calculator can be used to chart theoretical profit and loss PL for a diagonal call position.

The Calendar Call Spread Calculator can be used to chart theoretical profit and loss PL for a calendar call position. Clicking on the chart icon on the Diagonal Call Spread screener loads the strategy calculator with the selected diagonal call. A calendar put spread consists of two puts with the same strike price.

Some traders like to set a stop loss at 20 of capital at risk. In this notebook we will create a payoff graph of Calendar Spread at the expiry of the front-month option. It combines a long and short call which caps the upside but also the downside.

If the stock is near strike A when the earlier call expires you will be able to close it for a profit. A net debit of 100. It is a strongly neutral strategy.

That is for every net debit of 1 at initiation youre hoping to receive 2 when closing the position. A calendar call spread consists of two calls with the same strike. Time-decay is helpful while it is profitable but harmful when it is losing.

Long Calendar Spreads Unofficed

Forex Forex Trading Forex Factory Forex Signals Forexlive Forex Trading App Forex Rates Forex Calendar Forex Trading F Forex Trading Learn Forex Trading Forex

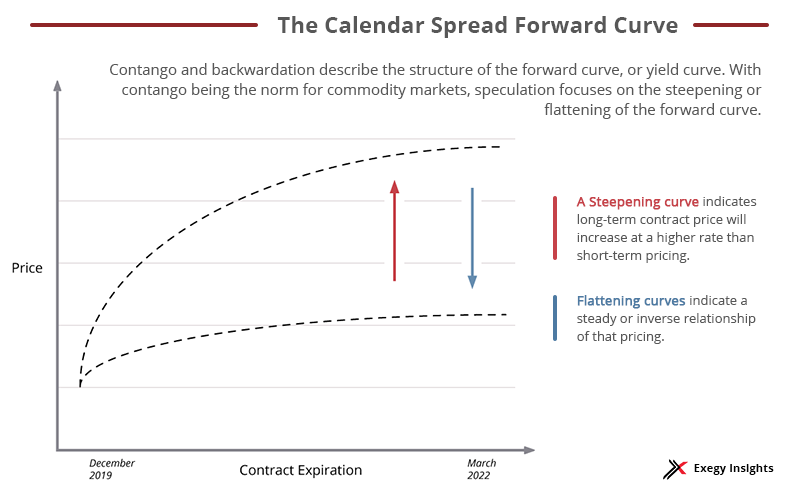

Getting Started With Calendar Spreads In Futures Exegy

Sell Call Option On 12 12 2016 Crus Jan 20 2017 60 00 Strike Price For A Profit Of 1 270 Daytraders O Call Option Options Trading Strategies Option Trading

Calendar Spread Options Trading Strategy In Python R Craft

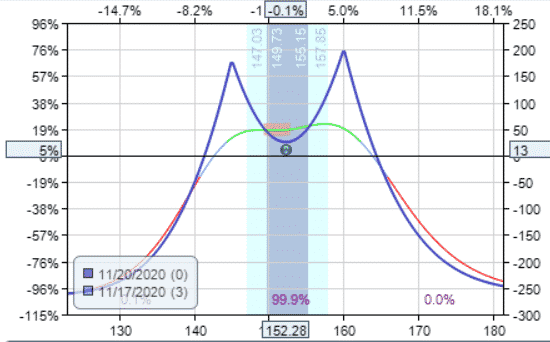

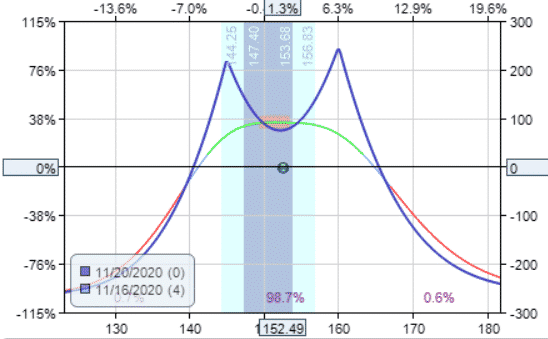

Double Calendar Earnings Trade Backtest Results

Best Risk Reversal Option Strategy Option Strategies Insider Option Strategies Strategies Put Option

Forex Forex Trading Forex Factory Forex Signals Forexlive Forex Trading App Forex Rates Forex Calendar Forex Trading For Be Forex Trading Forex Forex Currency

Put Calendar Spread Guide Setup Entry Adjustments Exit

Double Calendar Earnings Trade Backtest Results

Long Calendar Put Spread Calendar Spreads The Options Playbook

Long Calendar Spread With Calls Fidelity

Double Calendar Earnings Trade Backtest Results

Double Calendar Earnings Trade Backtest Results

How To Trade Neutral Calendar Spreads 3 Nifty Option Strategies Trade Limited Profit Loss Theoptioncourse Com

Long Calendar Spread With Puts Fidelity

Forex Forex Trading Forex Factory Forex Signals Forexlive Forex Trading App Forex Rates Forex Calendar Forex Tr Trading Strategies Forex Trading Stock Trading

Post a Comment for "Profit Calculator Calendar Spread"