Car Loan Calculator If You Pay Extra

From there the car loan calculator with extra payments will calculate how much you would normally have to pay versus the adjusted monthly amount. Total savings on interest R 000.

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Amortization Schedule

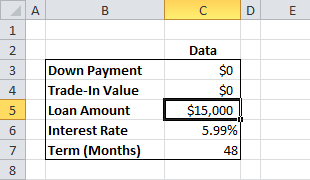

For example if you want the calculator to calculate the regular monthly payment enter 0 zero for the Periodic Payment and a non.

Car loan calculator if you pay extra. Whether youre making extra repayments off your home loan personal loan or car loan the more you pay off your loan the quicker youll be free of the debt. In general auto loan interest rates are fairly low compared with say credit card debt. Old monthly repayment R 000.

This early loan payoff calculator will help you to quickly calculate the time and interest savings the pay off you will reap by adding extra payments to your existing monthly payment. Use our extra payment calculator to determine how much more quickly you may be able to pay off your debt. Once you enter your details click Calculate and your loan information will be generated.

If for instance your 25000 5-year car loan 742 has a monthly payment of 500but you know you can afford 300 every other week then enter your inital loan information and the calculator will return a 250 bi-weekly payment based on your original payment. For instance using our loan calculator if you buy a 20000 vehicle at 5 APR for 60 months the monthly payment would be 37742 and you would pay 264548 in interest. You can also enter a monthly prepayment amount if you wish to make any additional regular payments to pay the loan off even faster.

This calculator is pretty straightforward. Paying extra on your car loan each month could provide valuable savings on interest and shorten the term of your financing. How our Car Payment Calculator with Extra Payments Works All you need to do is add in your original loan balance your loan term the interest rate how much you would like your extra monthly payment to be and the number of payments made.

Using our extra repayments calculator you can see how much time and interest you could save by paying more than the minimum repayment. If the rebate is 1000 it would be to your advantage to take the 0 financing because the 1000 rebate is less than the 264548 you would save in interest. The loan payoff calculator can help you make a plan to pay off your car loan faster.

Bond additional payment calculator. Begin by entering your anticipated date of your first payment the loan amount interest rate and length of the loan in months. Calculate how much you can save in terms of both time and money by paying a little extra into your bond.

From there enter the number of months left on the loan then enter how much extra youd like to pay each month to see how much sooner youd pay. This calculator uses your original loan amount length of the loan and interest rate to calculate your current monthly payments. Using the Auto Loan Calculator.

Try different loan scenarios for affordability or payoff. Use this calculator to see how making additional monthly payments can shorten the time to eliminate the debt. The calculator also includes an optional amortization schedule based on the new monthly payment amount which also has a printer-friendly report that you can print out and use to track your loan balance.

Then you can compare auto loan rates from Bankrates lending partners to find the best loan for your next car. New monthly repayments R 000. That is you will save a lot more in interest if you pay an extra 50 a month for the last 20 years than if you pay an extra 100 a month for the previous ten years.

Make Extra Payments Calculate how much your loan term and. Start Date - This is the day that you sign your car loan contract the first payment will come due one month later. Even just an extra payment of 20 per month can make a huge different over a 30 year term.

Loan Calculator with Extra Payments - Get an amortization schedule showing extra monthly quarterly semi-annual annual or one time only payments. By using an advanced calculator you can see the savings in a matter of seconds and persuade yourself to bite the bullet and pay more every time you receive your car or mortgage loan statement. Then you can add 50 to the extra payment amount to turn this 250 bi-weekly payment into a 300 payment.

Term Months - The number of months that your loan will run over typical terms for a car loan are 36 48 or 60 months. If you enter the loan amount and 0 for the down payment amount then the calculator will calculate how much down payment you need. If you have extra money use it to pay down high interest debt before tackling low interest debt.

By making a small additional monthly payment toward principal you can greatly accelerate the term of the loan and thereby realize tremendous savings in interest payments. For example the average credit card interest rate is currently 1786 while the average interest rate for a 60-month new-car loan is 473. Create amortization schedules for the new term and payments.

An early payoff means a quicker route to full vehicle ownership and no more car payments. Total loan amount R 000. Free fast and easy to use online.

Enter your loan details into the auto payoff calculator to estimate how much of a difference it could make for you. If you enter 0 for the price of the car a down payment amount 0 for the amount of loan the total periods the interest rate and the payment you can afford the calculator will calculate the amount of the loan and the price you can afford to pay for the car. As with many of our other calculators this calculator will also solve for an unknown input.

This calculator is provided courtesy of CalcXML to assist you in planning for your future. Use this calculator to determine 1 how extra payments can change the term of your loan or 2 how much additional you must pay each month if you want to reduce your loan term by a certain amount of time in months. Remember to enter the term of the loan in monthsa 30-year loan would be 360 months a five-year loan would be 60 months and so forth.

If You Drive A Pricey Vehicle Already Don T Bring It With You On Your Car S 15 Year Mortgage Amortiz Mortgage Amortization Loan Calculator Mortgage Estimator

Car Loan Amortization Calculator With Auto Amortization Schedules

Car Loan Calculator How Much Car Can I Afford

Pin By Andrea Desjardins On Financials Car Loan Calculator Loan Calculator Loan Amount

Auto Loan Calculator Estimate Monthly Car Payments Online For Free

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Loan

Auto Loan Calculator Estimate Your Monthly Car Loan Payment Car Loan Calculator Car Loans Loan Calculator

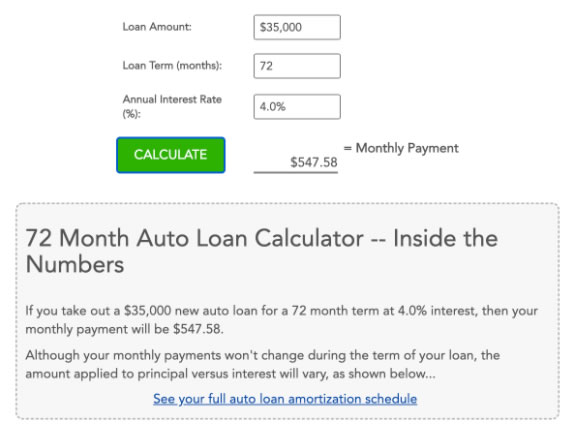

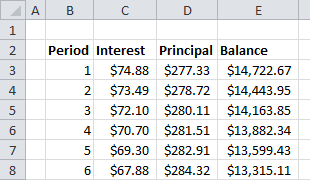

72 Month Auto Loan Calculator Investinganswers

Pin On 20 Year Amortization Calculator

Auto Loan Interest Calculator Monthly Payment Total Cost

What To Do When You Pay Off The Car Loan Car Loans Paying Off Car Loan Car

Online Auto Loan Monthly Payment Calculator Spreadsheet Car Loans Mortgage Payment Calculator Car Payment Calculator

Create A Car Loan Calculator In Excel Using The Sumif Function Part 2

How To Acquire The Most Excellent And Feasible Used Car Loan From Day Cash Loans Company In Uk Loan Company Car Loans Loan Lenders

How To Get Rid Of A Car Payment Even If You Re Upside Down Car Payment Car Loans How To Get Money

Auto Loan Payoff Calculator For Calculating Early Payoff Savings Loan Payoff Car Loans Best Payday Loans

72 Month Auto Loan Calculator Investinganswers

Create A Basic Car Loan Calculator In Excel Using The Pmt Function

Printable Car Loan Amortization Schedule Amortization Schedule Car Loans Loan

Post a Comment for "Car Loan Calculator If You Pay Extra"